You need your API Key ID & Secret Key to use this app.

Manage Your Algorithms

View your performance and buying power

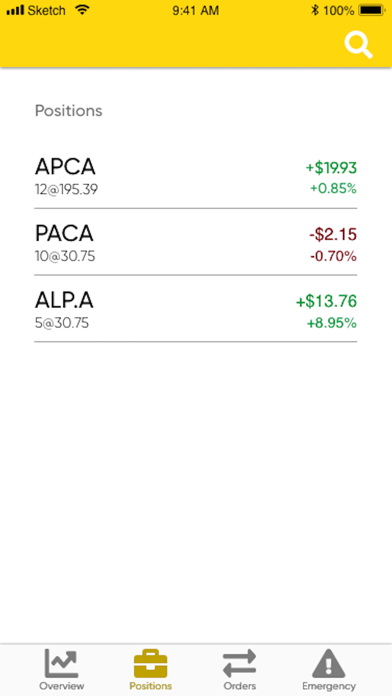

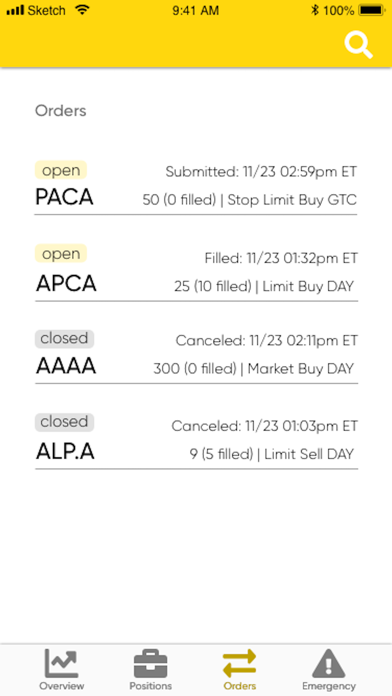

See the status of all positions and all orders for the day

Easily Take Action

Take emergency actions, including canceling orders and liquidating positions

Manually enable/disable your account’s API access

Manually place trades to buy/sell stocks

Disclosures

Brokerage services by Alpaca Securities LLC ("Alpaca"), member FINRA/SIPC, a wholly-owned subsidiary of AlpacaDB, Inc.

Brokerage services are provided to customers who can write automated investment code and self direct their own investments.

This is not an offer, solicitation of an offer, or advice to buy or sell securities, or open a brokerage account in any jurisdiction where Alpaca is not registered (Alpaca is registered only in the United States).

The Paper Trading API is offered by AlpacaDB, Inc. and does not require real money or permit a user to transact in real securities in the market. Providing use of the Paper Trading API is not an offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, or any type of trading or investment advice, recommendation or strategy, given or in any manner endorsed by AlpacaDB, Inc. or any AlpacaDB, Inc. affiliate

Market prices, data and other information available through Alpaca are not warranted as to completeness or accuracy and are subject to change without notice. System response and account access times may vary due to a variety of factors, including trading volumes, market conditions, system performance, and other factors. A more complete description of the impact these factors may have can be found in our risks of automated trading systems section.

All investments involve risk and the past performance of financial product does not guarantee future results or returns. Note that while diversification may help spread risk it does not assure a profit, or protect against loss, in a down market. There is always the potential of losing money when you invest in financial products. Investors should consider their investment objectives and risks carefully before investing.

There are risks unique to automated trading algorithms that you should know about and plan for. You should setup a method or system of continuous monitoring or alerting to let you know if there is a mechanical failure, such as connectivity issues, power loss, a computer crash, or system quirk. You should also monitor for instances where your automated trading system experiences anomalies that could result in errant, missing, or duplicated orders. A more complete description of these and other risks can be found in our FAQ section.

ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. Some ETFs may involve international risk, currency risk, commodity risk, and interest rate risk. Trading prices may not reflect the net asset value of the underlying securities.

All accounts are opened as margin accounts but do not allow margin loans or short selling. You will be required to take specific steps at the time these are allowed in your account.

You should know that margin trading involves interest charges and risks, including the potential to lose more than deposited or the need to deposit additional collateral in a falling market. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. For more information see Alpaca’s Margin Disclosure Statement and Margin Agreement. These disclosures contain information on Alpaca’s lending policies, interest charges, and the risks associated with margin accounts.

Commission Free trading means that there are no commission charges for Alpaca self-directed individual cash brokerage accounts that trade U.S. listed securities through an API. Relevant SEC and FINRA fees may apply.